Key Takeaways

- Digital receipts provide real-time monitoring and instant access to expense data.

- Automation reduces the margin for error, increasing accuracy and reliability.

- Compliance and audit processes are simplified with easily accessible electronic records.

- Businesses can realize significant cost savings while helping the environment by reducing paper waste.

- Seamless integration with financial software delivers actionable insights and optimization opportunities.

Tracking business expenses has evolved far beyond the limitations of traditional paper receipts. As the volume of receipts grows and expectations for transparency increase, businesses are turning to digital solutions for clarity and control. Technologies like smart receipt management streamline expense documentation, ensuring financial records remain both organized and accessible. This digital approach isn’t just about convenience—it’s about creating reliable, real-time visibility into company spending.

Adopted widely by businesses of all sizes, digital receipts enable finance teams to transition from reactive bookkeeping to proactive financial oversight. From instant data capture to reducing the risk of lost paperwork, these systems empower better budgeting, spending insights, and compliance. As expense reporting systems become smarter and more connected, adopting digital receipts is rapidly moving from an option to an operational necessity.

Digital receipts also form the backbone for robust auditing and tax documentation. Their integrated, searchable format eliminates countless hours spent sorting and matching paper receipts, freeing employees to focus on tasks that add real value. Most importantly, they help drive measurable savings and sustainable practices that benefit both the bottom line and the environment.

Real-Time Expense Tracking

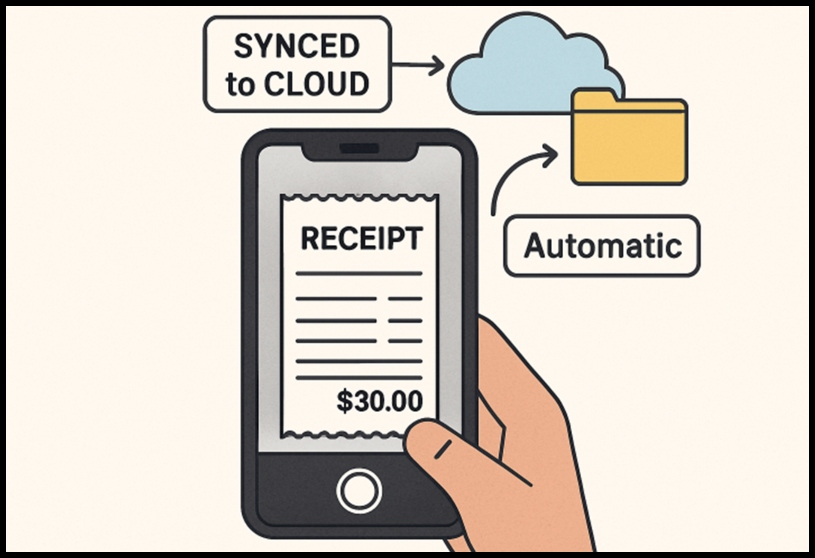

One of the most significant benefits of digital receipts is the ability to track expenses in real-time. Employees can immediately upload receipts using their phones or connected devices, ensuring every transaction is timestamped and readily available for review. According to a report from CNBC, such automation is empowering small businesses to respond more quickly to shifting costs and budget adjustments, helping them avoid pitfalls that frequently arise from outdated or incomplete data.

Finance teams can then monitor spending on an ongoing basis, rather than waiting until the end of the month or quarter. This continuous flow of information enables managers to identify trends, spot anomalies, and make timely adjustments to stay within budget. With every transaction recorded instantly, organizations are better positioned to make data-driven decisions regarding company spending.

Enhanced Data Accuracy

Manual entry of expense data often leads to errors, lost information, and inconsistencies that impair decision-making. Digital receipts automatically extract information from receipts and match them to transactions within the accounting system, minimizing human error. Not only does this reduce the administrative burden on employees, but it also significantly enhances data integrity throughout the organization.

AI-powered extraction tools and standardized digital formats facilitate the reconciliation of expenses with bank statements and company policies. This streamlined process ensures reports are both timely and accurate—a critical factor when preparing for audits or making high-stakes financial decisions. Accurate data is also essential for effective budgeting and forecasting, reducing the likelihood of unpleasant financial surprises.

Improved Compliance and Audit Readiness

Regulatory compliance is a top concern for businesses of all sizes. Digital receipts store data in a centralized, easily searchable electronic archive, making retrieval straightforward during audits or tax reviews. The Internal Revenue Service (IRS) accepts digital copies as valid documentation, reducing the need for physical storage and the risk of lost paperwork.

This digital approach also enables companies to generate comprehensive audit trails for internal and external reviews instantly. With standardized, organized records, auditors can quickly validate transactions, minimizing disruptions and expediting compliance checks. This drastically reduces the anxiety and resource drain often associated with audit preparedness.

Cost Savings and Environmental Benefits

Embracing digital receipts yields significant cost benefits, as businesses no longer have to spend on receipt paper, printer ink, or physical storage. The National Resources Defense Council reports that nearly three million trees and billions of gallons of water are consumed each year to produce paper receipts in the U.S. alone—a resource-intensive process that many organizations now avoid through digitization.

Not only does this transition cut costs, but it also aligns with sustainability initiatives by reducing a company’s carbon footprint. Adopting digital receipts sends a strong message to stakeholders and customers about an organization’s commitment to responsible resource use and environmental stewardship.

Integration with Financial Systems

Modern digital receipt solutions readily integrate with enterprise resource planning (ERP) systems, accounting software, and payroll applications. These integrations facilitate seamless data flows, reducing manual processing and enabling automated categorization, approvals, and analysis. Insights from connected receipt management tools help identify savings opportunities and improve financial forecasting.

This level of integration enhances collaboration between finance teams and other departments, ensuring company-wide visibility over spending patterns. Leadership teams can quickly generate detailed reports or dashboards, allowing for informed, real-time decision-making. Ultimately, integrated digital receipts catalyze strategic growth and enhanced competitive positioning.

Final Thoughts

Digital receipts have fundamentally transformed expense management by delivering unmatched transparency, accuracy, and efficiency. As businesses confront a rapidly changing financial landscape, implementing solutions positions them for success by simplifying workflows, reducing risk, and advancing sustainability initiatives. The advantages—ranging from streamlined compliance to cost reduction—make digital receipts an essential tool for organizations seeking to achieve better expense visibility and long-term financial health.